Prioritising women in our investments

We continue to find new ways to maximise impact for women. For example, we focus on ‘directed lending’, where the capital we provide to financial institutions is earmarked for female customers. In 2024, we invested in KCB Bank Kenya to increase its lending capacity to women-owned and -led small and medium-sized enterprises, as well as climate-related projects. Another recent investment is in BRAC Bank in Bangladesh, where our commitment will be used as a directed lending line to provide finance for MSMEs and women-owned and -led businesses in the country (see case study).

Gender bonds are another increasingly used financing tool, to support the economic empowerment of women and girls. In 2024, we published a gender bonds toolkit in partnership with FSD Africa, FSD Network and UN Women, to provide guidance on how to design and issue gender bonds with a focus on advancing gender equality in Africa. Since then, we’ve held launch events and training in Nairobi, Lusaka and Lagos.

We continue to partner with businesses in our portfolio to maximise impact for women. Through our technical assistance facility, BII Plus, we backed Veritas, an Indian non-financial banking company, to support women entrepreneurs and launch a product designed specifically for women. This enabled Veritas to launch Dhana Shakti, a collateral-free loan product with lower fees, designed specifically to address barriers faced by women-led MSMEs. This has already reached over 1,600 customers and Veritas’ women borrower numbers grew by 60 per cent between 2023 and 2024.

Sharing what we’ve learnt

To mark six years since we first published our Gender Finance Strategy, in 2024 we published a new report, “Closing the gap: Lessons from six years of investing in women”. It outlines the progress we’ve made, shares the lessons we’ve learnt, and explores what more can be done to promote gender equality in emerging economies. We also published an evaluation on how businesses with female owners and leaders support positive outcomes for women. The evaluation found that businesses with gender-diverse leadership show higher standards in gender-smart business practices compared with others.

We continue to champion the growth of the gender-lens investing industry. In 2024, the 2X Framework was updated to strengthen the rigour with which we, and other investors, qualify 2X investments. BII has provided ongoing support to 2X Global to further refine and improve guidance on implementation of the new 2X Criteria and Framework. This will help build the quality of gender finance. We are pleased to be part of the third phase of the 2X Challenge, in which members have collectively committed to mobilise at least $20 billion over three years under this new strengthened standard.

Our training programme on gender-based violence and harassment continues to move from strength to strength. In 2024, we delivered training to over 550 participants across 11 countries. This included partnering with four DFIs – Proparco, DFC, DEG and Norfund – to deliver a new advanced training programme. The training, which is funded by our technical assistance facility, BII Plus, equips companies with practical tools and strategies to tackle these issues.

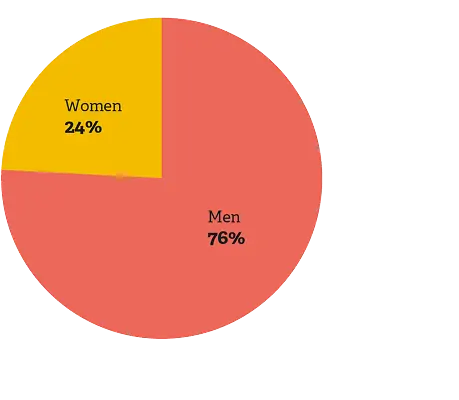

Increasing diversity across our portfolio

Across the impact investment ecosystem – from DFIs to private equity and from venture capital funds to the philanthropic community – there is increasing recognition of the need to take a more diverse approach to allocating capital. As a long-term partner to businesses in Africa, we are stepping up our approach. We have committed to increase the representation of Black-owned and -led businesses in our sub-Saharan Africa portfolio. Investments include H1 Capital, a South African Black-owned and managed renewables investment and development company that is expanding access to clean and affordable energy in the country. Our recent investment in Johnvents, one of Nigeria’s largest cocoa processors (see case study) also shows our support for Black-owned and -led businesses in Africa, which often struggle to get the funding they need to grow.